如果你跟着我 推特 要么 脸书 有一阵子,或者已经阅读了我的一些博客文章,您可能会意识到我非常喜欢 Wise (formerly TransferWise) for international transfers and payments. Wise keeps foreign exchange fees extremely low and gives customers a better exchange rate than most banks by passing on the actual daily exchange rate rather than incorporating an exchange margin. With most banks in 澳大利亚, this margin is around 3%. On a $100 purchase, that’s a $3 saving just on the exchange rate. Many banks also charge a fee on foreign exchanges and foreign purchases. Wise fees are typically much lower.

If you receive money in foreign currencies, Wise can save you even more money by facilitating storage of the foreign currency and spending it without transferring it back to your base currency first.

免责声明: This is not financial advice and you should do your own research.

我们的情况

因此,例如,我的基本货币是AUD。但是,我从某些会员合作伙伴处收到以美元支付的佣金。他们直接存入我的银行帐户。我也付钱 金斯塔 以美元支付我的网站托管费用。

Before Wise, those commission payments would go into my bank account and my bank would deduct a fee to convert that into AUD. I’d then pay 金斯塔 通过信用卡付款,我的银行会向我收取费用,以将澳元转换为美元。

If only I didn’t have to convert that USD back to AUD first! With Wise, this is completely possible.

So, if you don’t have a multi-currency account with TransferWise yet, go and 开设您的免费帐户.

Set up your multi-currency accounts in Wise (formerly TransferWise)

Ok, so you have opened up a Wise account. You’ll have a base balance automatically setup in your chosen base currency. For me, that’s AUD.

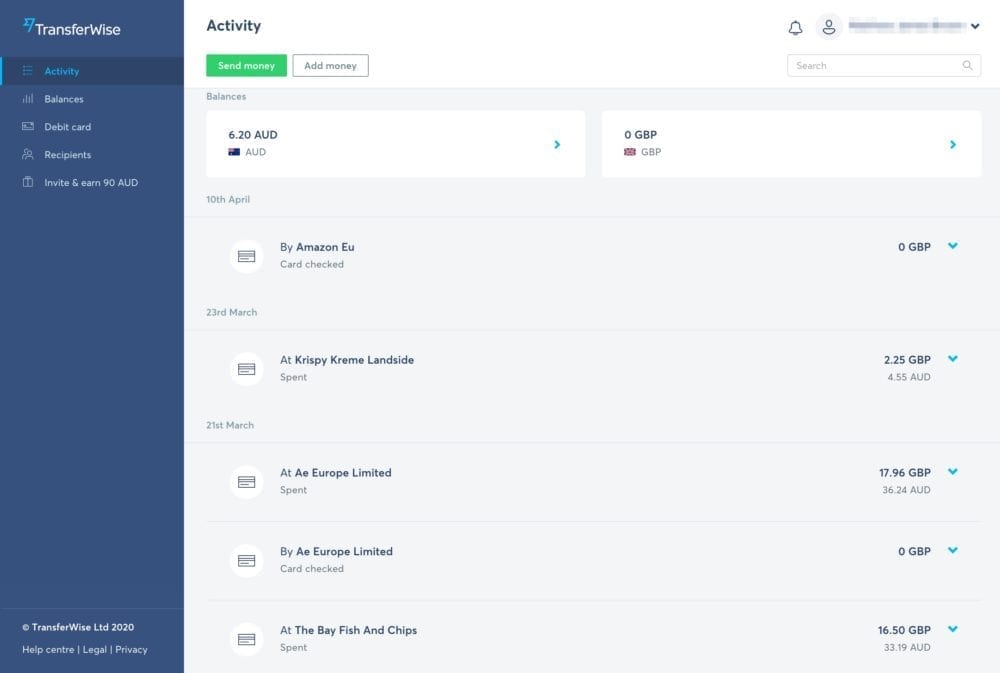

登录帐户后,默认情况下会看到活动屏幕。从这里,您可以看到所有交易活动,就像在常规的网上银行中一样。您的余额将显示在顶部。在我的账户中,除了我的澳元余额外,您还可以看到我目前还有一个GBP余额设置。

Straight away, I can start loading my base currency by transferring money from my bank to the Wise bank account details provided, or by clicking the “Add AUD” button (or whatever currency your base currency is).

现在,如果您没有收到外币的款项,则可以直接跳至“取得TransferWise借记卡“ 部分。不过对我来说,我想以美元收款并将其保存在美元帐户中,直到准备使用为止。

为此,我需要设置美元余额。您可以在上面的屏幕快照中看到与以前将GBP余额添加到我的帐户中的过程相同的过程。

开立外币余额

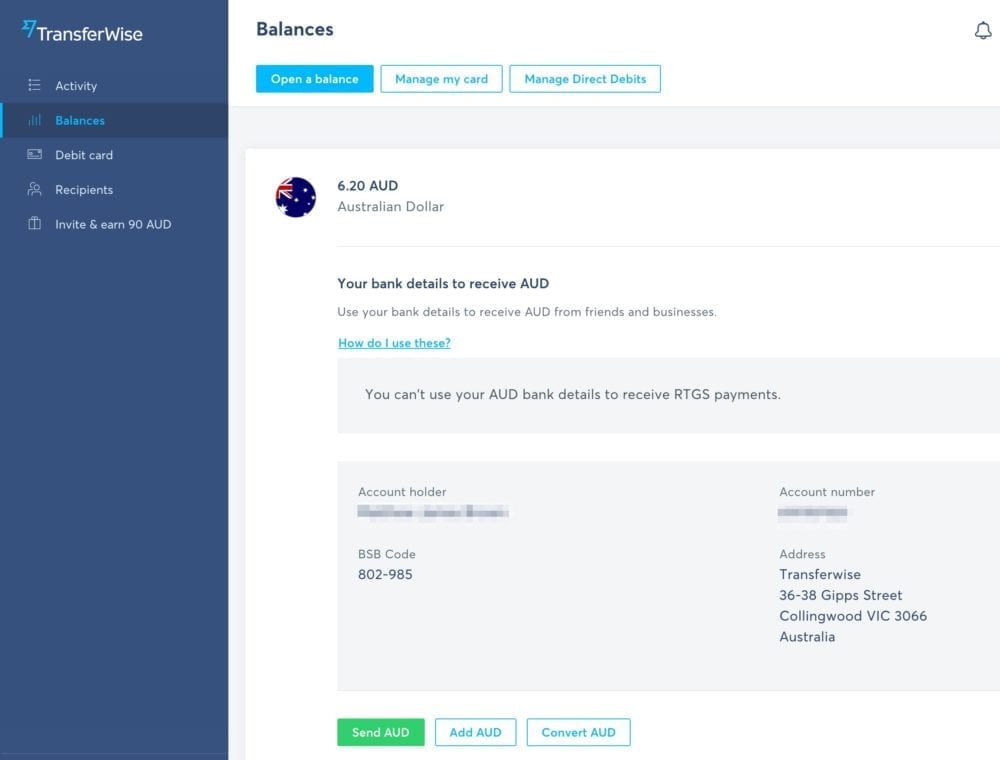

单击菜单中的“余额”链接以转到余额屏幕。该屏幕将向您显示当前余额的列表,每个余额中的余额以及如何向其中添加资金。

这个过程和概念与旅行理财卡非常相似,例如 澳航旅行钱 和 澳大利亚邮政旅行万事达卡但是,与这些卡片不同, TransferWise 使用起来更便宜,并且可以为您提供大多数主要货币的银行详细信息。具有银行详细信息,使您可以像实际银行帐户一样使用每个余额来接收外币资金。

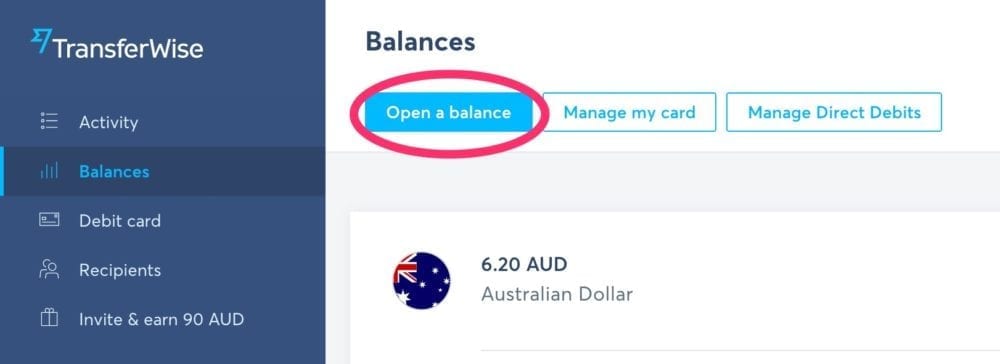

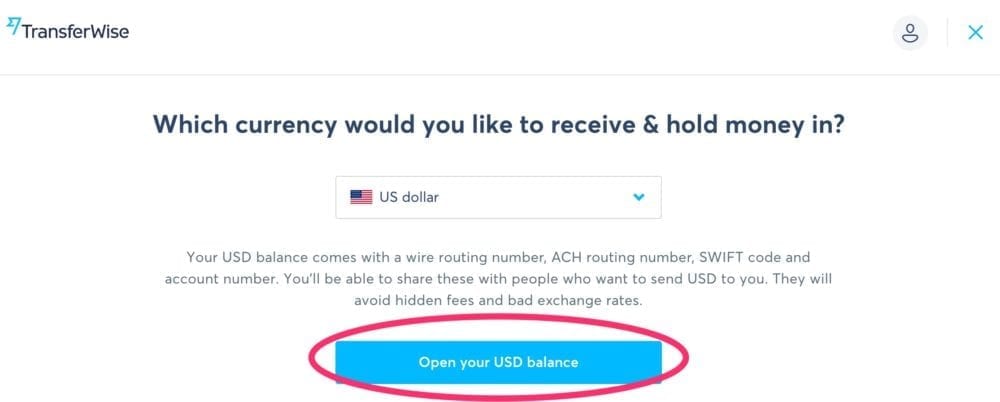

To open a new balance in Wise, click the “Open a balance” button at the top of the balances screen.

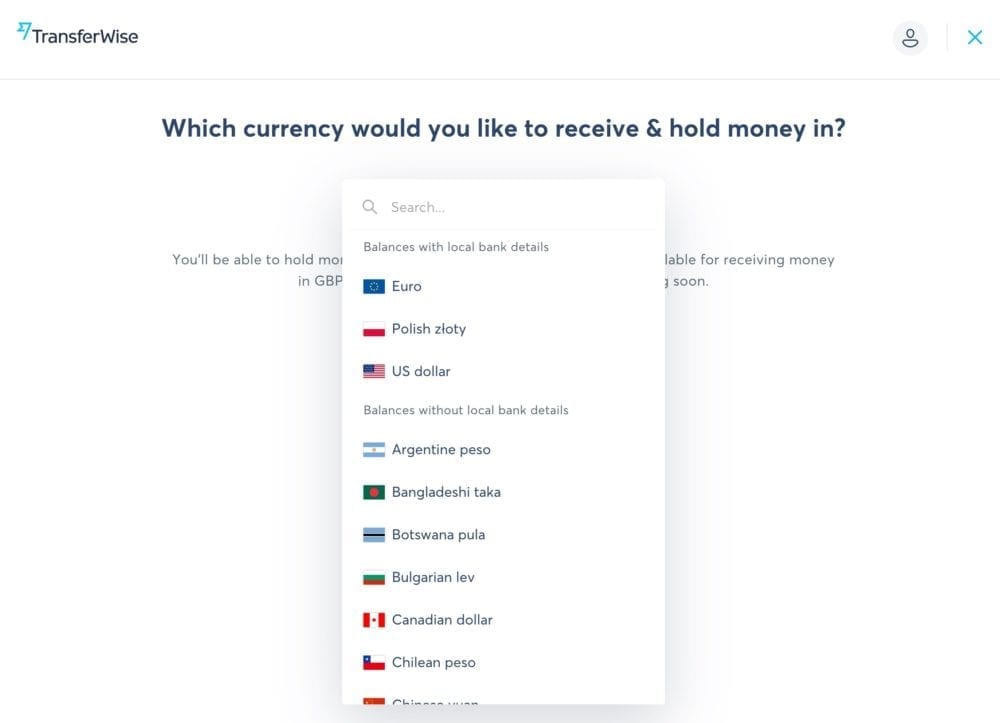

您将被带到打开余额屏幕,并可以选择要使用哪种货币作为新余额。

您可以从40多种货币中进行选择,远远超过通常约10-15货币的旅行钱卡。但是,如果需要银行详细信息,则必须从支持本地银行详细信息的货币中选择一种。目前,这些是AUD,USD,GBP,EURO和PLN(波兰兹罗提)。

我已选择美元作为新余额。点击“打开您的USB余额”按钮继续进行设置。

Wise will now set up your new balance and let you know when it is ready.

即使USD支持本地银行详细信息,也不会自动创建它们。如果需要,您必须要求他们。因此,请点击蓝色的大按钮“ Got it”,然后继续前进。

获取外币的本地银行详细信息

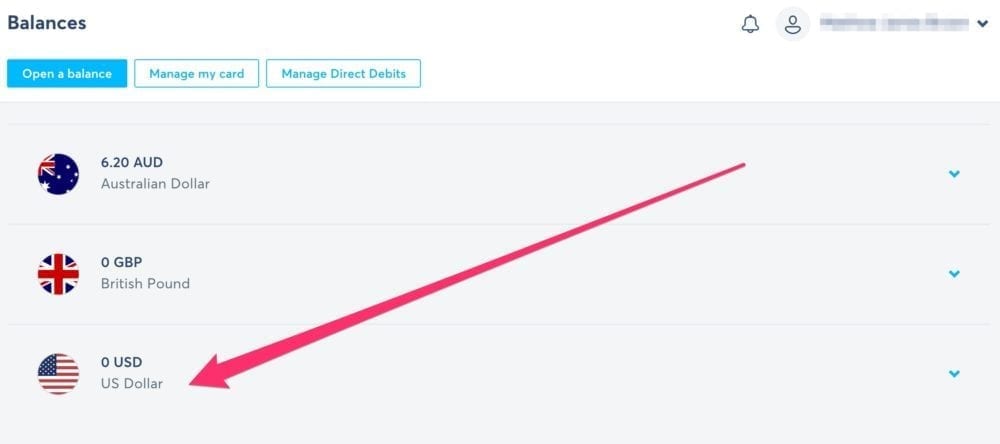

您将被带回到余额屏幕,新的余额现在可见。点击天平将其展开。

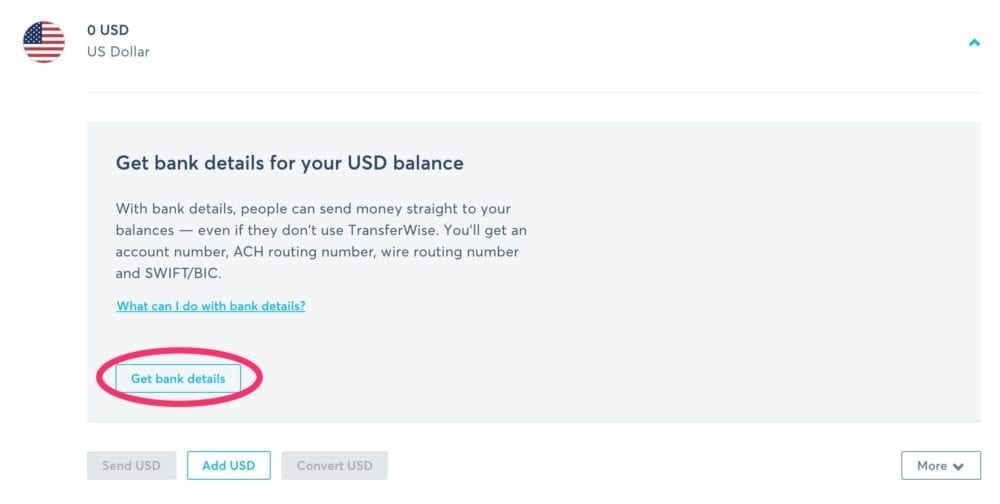

将显示向您添加资金到余额中的选项以及“获取银行详细信息”按钮。

If you don’t need bank details, you can add funds by clicking the “Add USD” button and following the instructions. TransferWise will provide you with instructions to load money. We’re going to click the “Get bank details” button though.

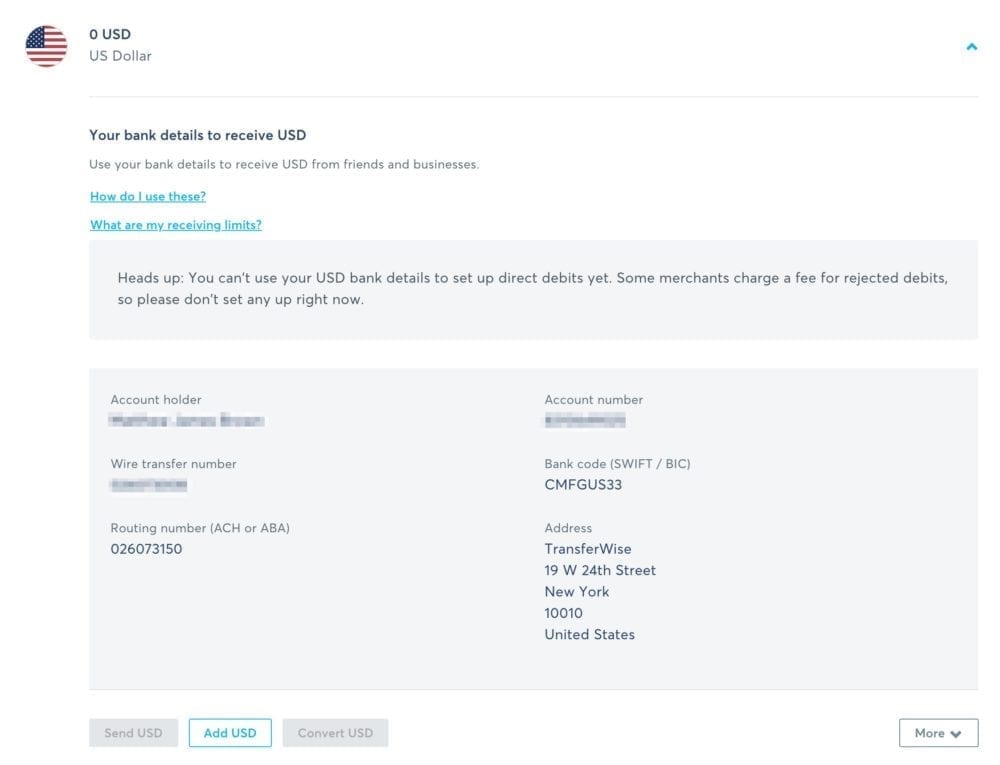

余额将重新加载您的新外币银行详细信息,以及有关限制的任何信息,这些限制可能适用于您如何使用该货币的银行详细信息。

目前,美元帐户对可以从其他美元帐户中存入多少资金有限制(如果您要从另一种货币转换资金,则不存在限制),并且目前还不能通过直接借记设置美元银行详细信息(因此无法将其连接到PayPal并让PayPal从您的USD余额中扣除USD交易)。

注意: some foreign currencies do support direct debits, Euro and AUD for example.

This is great, just what I want! Now I can have my USD commissions paid straight into my USD balance using these bank details. No need for converting to AUD unless I want to.

But, how do I now use this to pay for my website hosting and other USD transactions when direct debits are not supported?

Well, that’s where the TransferWise debit card comes in.

取得TransferWise借记卡

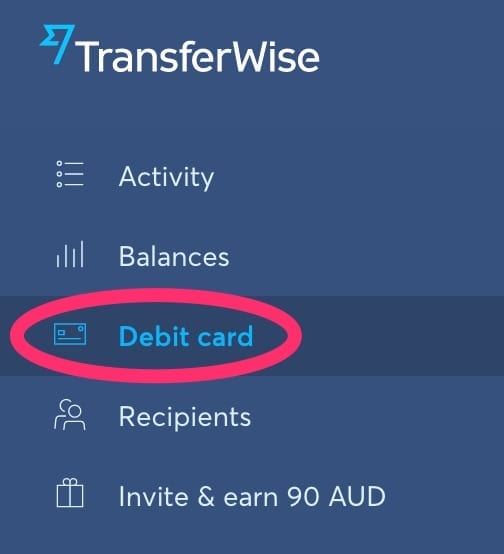

Wise does prompt you to order a debit card when you first set up your account. So chances are, you might already have one. However, if you didn’t order one during account setup, you can do so by clicking the “Debit Card” link in the menu of your account.

Please note that since May 6, 2020 in the EU and UK and May 20, 2020 for other countries, a one-time fee applies to get a debit card.

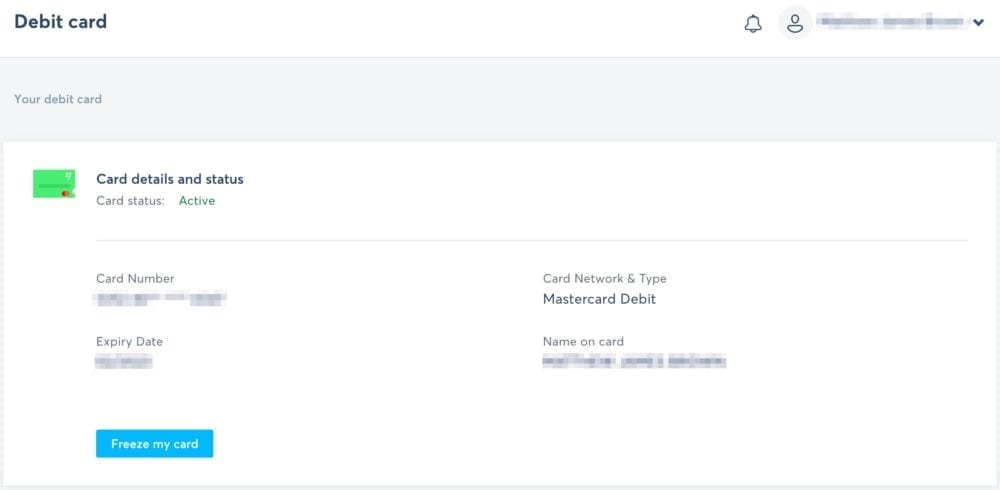

You will be taken to the debit card screen. If you already have a debit card (or have one on order), it will show you the details. It should look something like this if you have a debit card. If it hasn’t arrived yet the status will not be active, instead, it will show you the current status.

If you don’t have a card already or on the way, there will be a button on this screen to order a card. Click it and follow the instructions.

Once your card arrives in the mail, it will have instructions with it on how to activate it. Do this, and then you are good to move on to the next step, spending your foreign currency!

花费外币而无转换费

The type of debit card you receive may vary depending on what your base currency is, and depending on the current relationship that Wise has with card issuers. Right now, in 澳大利亚, the debit card is a Mastercard debit.

It’s also neon green, so it really stands out.

You can use your Wise debit card to make purchases anywhere that accepts Mastercard payments. In 澳大利亚, this means you can use it at any EFTPOS terminal, online, through PayPal, with pay later services like ZipPay and AfterPay, and also to withdraw cash from ATM’s. It also means you can use it overseas anywhere that accepts Mastercard, including most online stores.

To use the card for online purchases, you have a choice, either pay by card directly or pay through PayPal. Here’s how both those scenario’s work

使用我的TransferWise卡以外币支付

Simply use your Wise card at the checkout like you would any other credit or debit card. Enter the card details and away you go.

Here’s what happens when you place an order. Let’s say I’m paying $100 in USD.

Wise will check my USD balance first. If I have $100 in that balance, then it will be used to pay for the purchase.

If I don’t have any USD, Wise checks my other balances and calculates what combination of other currencies will provide the best value conversion rate with the lowest fees. It might be that I have enough GBP to cover the purchase and that gets a better value conversion than AUD. In this case, Wise will convert enough GBP into USD to cover the purchase.

If I have $80 in my USD balance, Wise will use that, and then it will check my other balances to work out the best value conversion for the remaining $20. That $20 will then be converted from one of my other balances that gets the best rate and lowest fee.

So in my example where I have to pay for my website hosting in USD, I log into my Kinsta account and add my Wise card as my preferred billing method. Now, Kinsta will bill my TransferWise card and automatically use my USD commissions first before moving to my other currencies. Now I don’t have to pay conversion fees and lose money in foreign exchange rates going backwards and forwards between USD -> AUD -> USD. AWESOME!!!

Paying in a foreign currency with my Wise card connected to my PayPal account

PayPal is another common way of managing international payments, and yes, you can receive USD directly into your PayPal account as well. PayPal fees for conversion between your balances are excessively higher than Wise though, so it isn’t a good solution for managing your international currencies.

It is possible, however, to setup your Wise debit card with PayPal so that you can use your Wise balances through PayPal.

将您的TransferWise借记卡链接到您的PayPal帐户

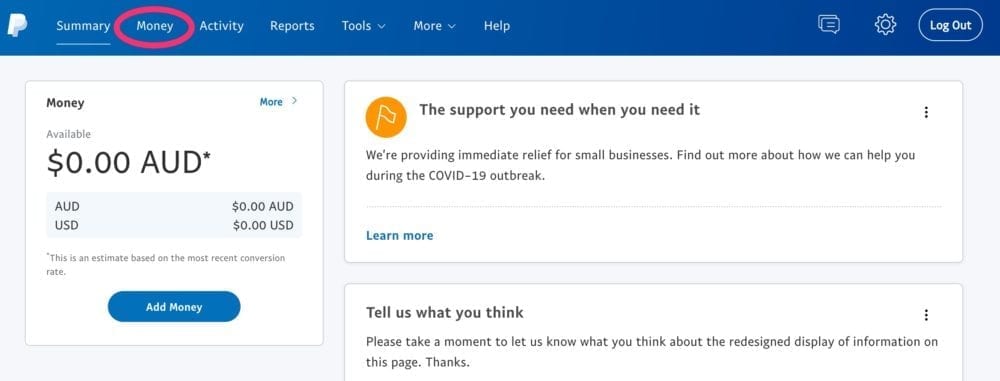

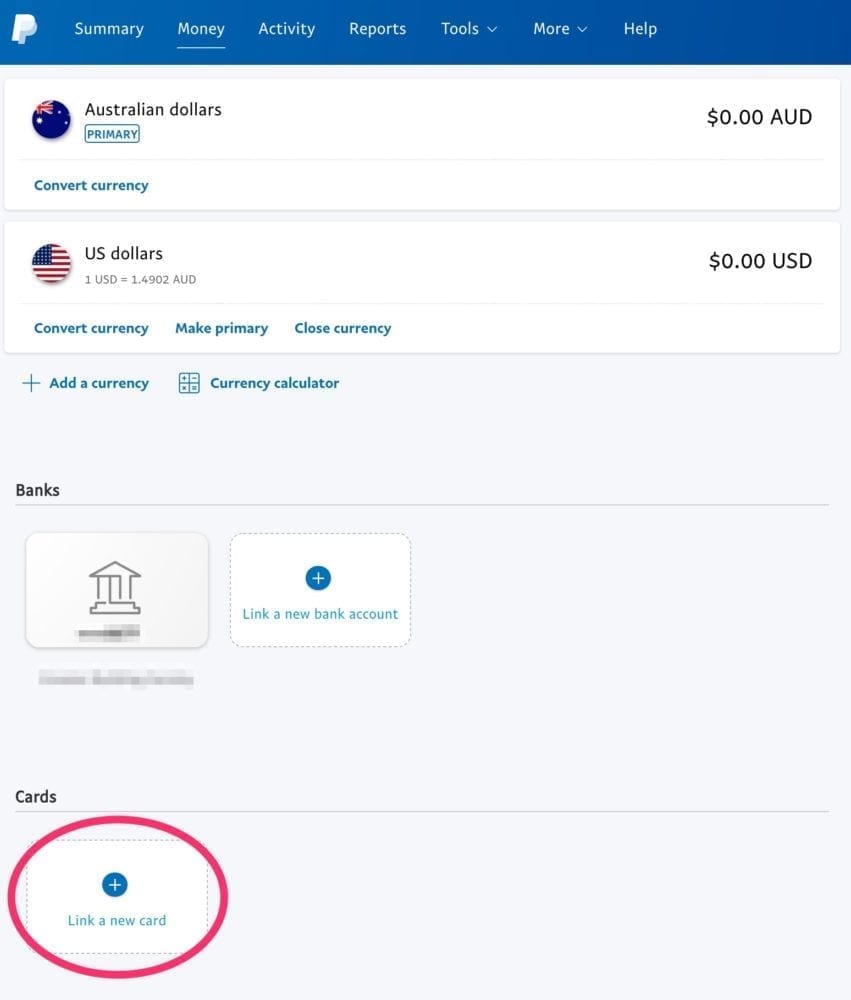

To set this up, log into your PayPal account and click the “Money” tab.

From the money screen, scroll down to the “Cards” section and click on the “Link a new card” button. If you already have some cards linked to your account then they will show up here as well.

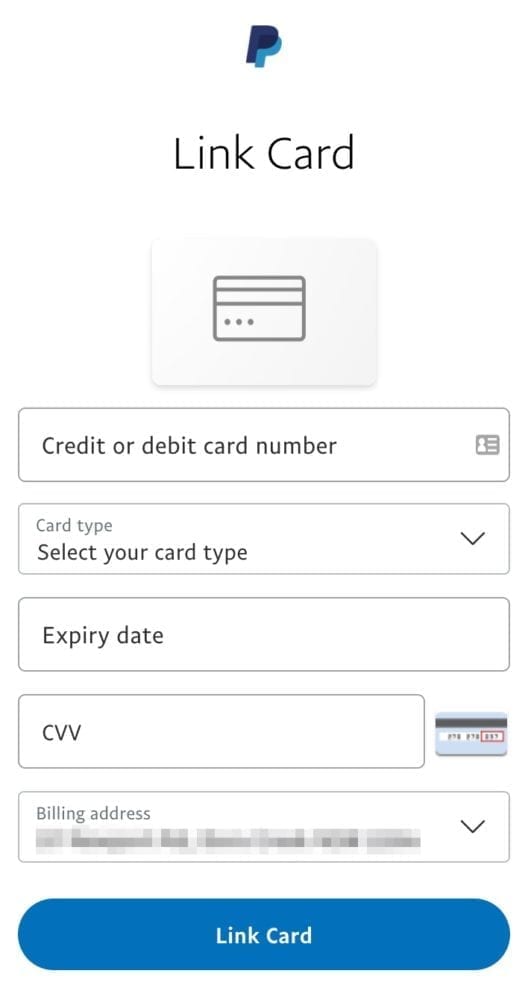

On the screen that appears, enter your Wise debit card details, as you would with any other debit or credit card.

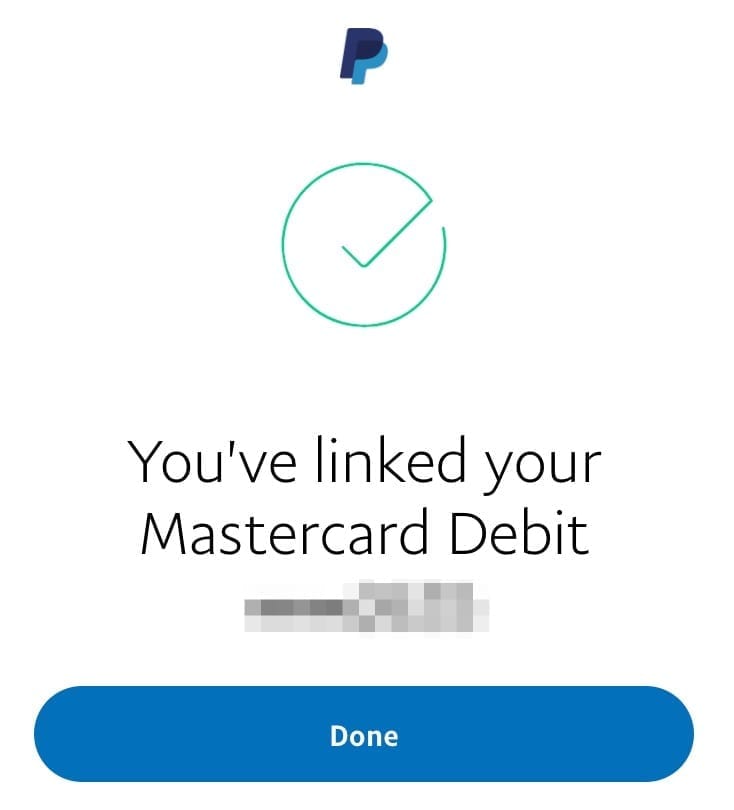

Click the “Link Card” button and assuming you entered your card details correctly, you should see a success screen.

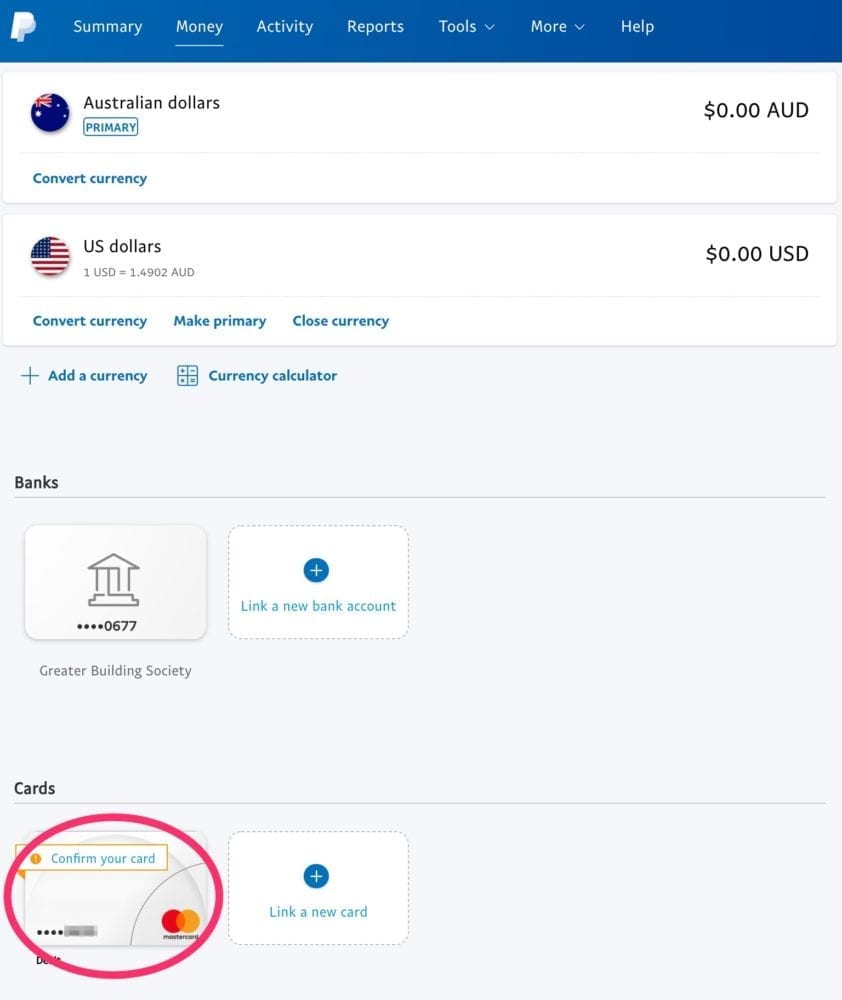

Now, click “Done” and you will be taken back to the Money screen. Your Wise debit card should now be listed in the cards section.

You can click “Confirm your card” to go through the process of verifying the card with PayPal, but it is not essential to get things up and running.

Now that your card is linked, you can begin using it.

Paying with your Wise card without PayPal currency conversion

When you make a purchase in a foreign currency, PayPal always defaults to doing the currency conversion for you. Why? Well, they would tell you it’s for your convenience so you know exactly what you are going to pay. The caveat is that this often isn’t exactly what you are going to pay because banks often add a foreign transaction fee if the merchant is overseas, even if you pay in your local currency. This is especially true here in 澳大利亚.

The real reason PayPal defaults to doing the currency conversion is because they charge excessively high conversion fees, so they make a lot from you when you choose to use their conversion service. To avoid these fees and make sure you are using your foreign balance on your Wise card, always choose to pay in the billing currency without PayPal currency conversion. Here’s how.

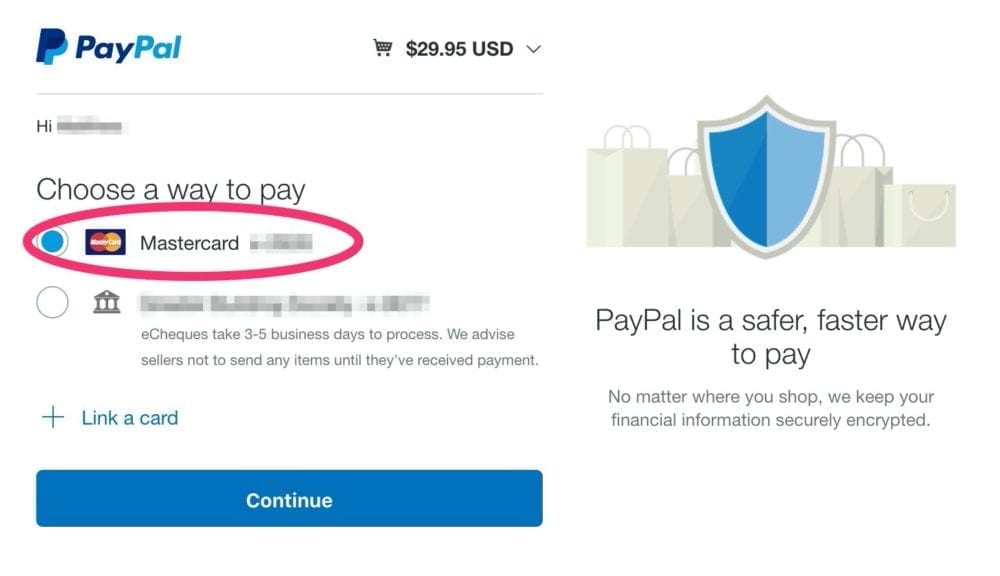

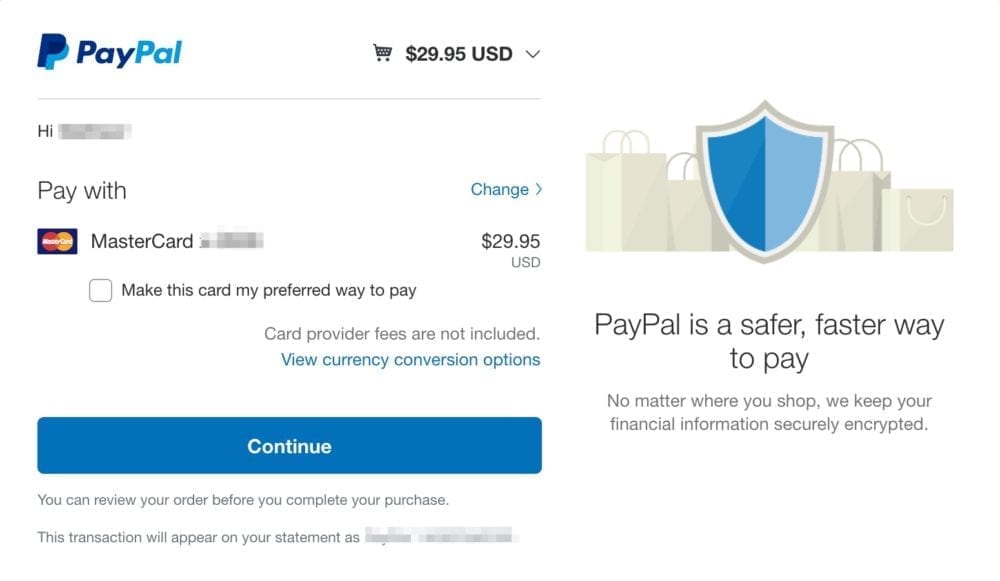

Proceed to pay as you normally would. After logging into your PayPal account to process payment, select your Wise card.

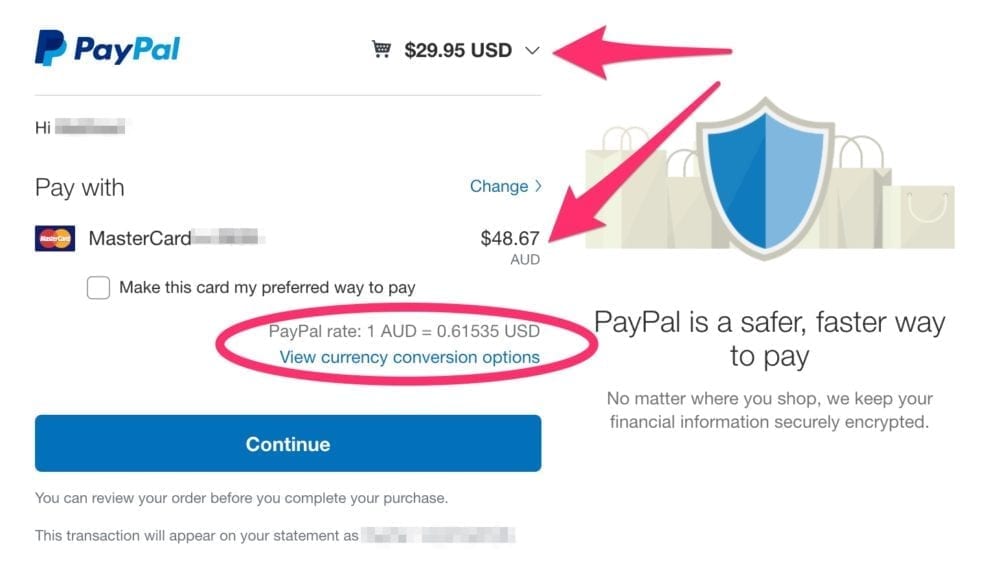

Click “Continue” and PayPal will show you what is going to be charged to your card in what currency. This is where it typically defaults to your local currency. As you can see below, PayPal would like to convert this USD purchase to AUD for me. I don’t want that though.

To change this, click “View currency conversion options”.

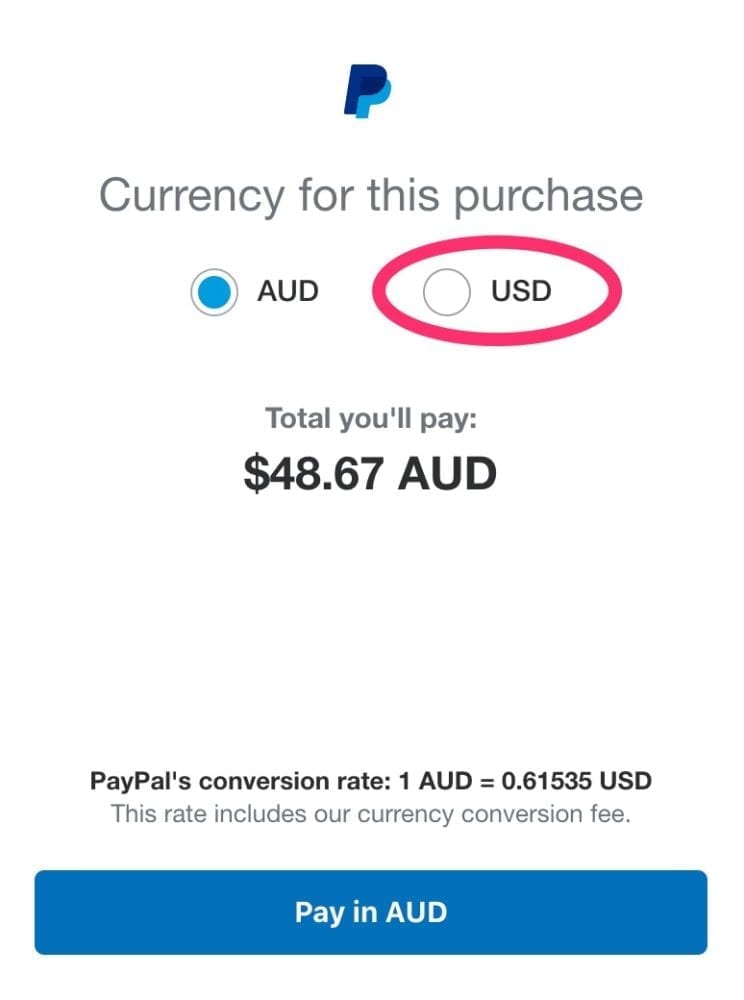

Select the original currency (in this case, USD) from the currency conversion options screen.

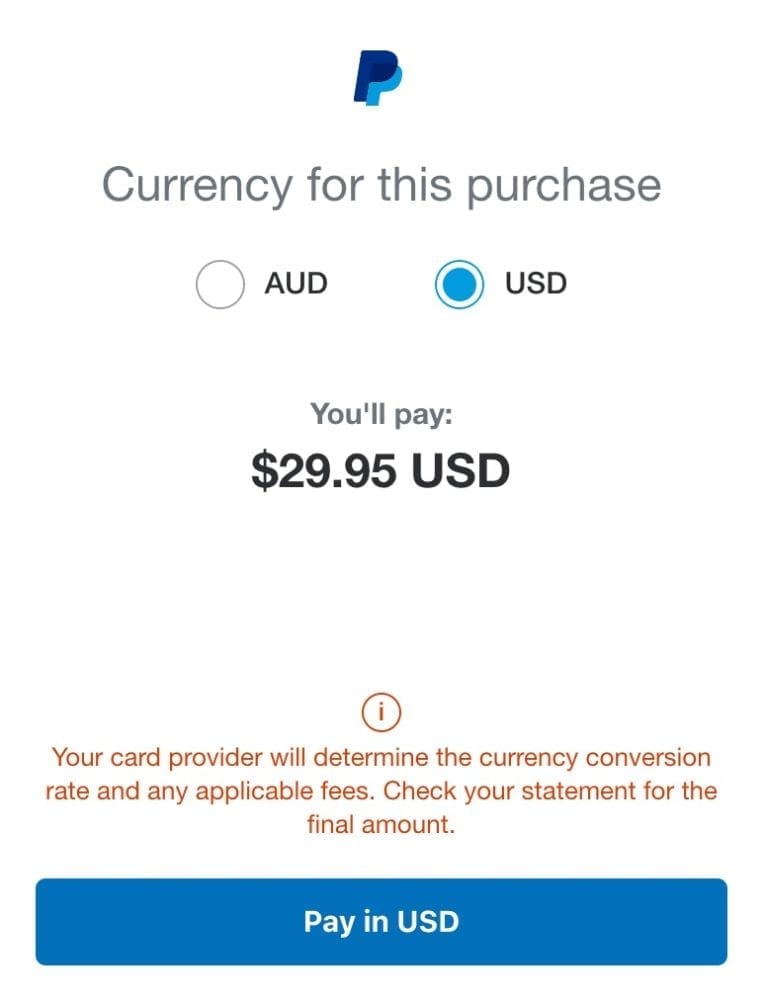

PayPal will update to show you the new amount in the original currency and confirm that your card provider (Wise) will determine the conversion rate and any fees.

Click “Pay in USD” (or whatever currency it is that you have selected).

You will be taken back to the PayPal payments screen where you can finalise payment. Just double check to make sure that it does show that you are paying in the currency you are expecting. I’ve had occasional issues with this.

That’s it. Click “Continue” and proceed to complete the transaction as normal. Your Wise card will be used to make the payment and funds will be taken from the appropriate balance, or converted from one of your other balances if you don’t have enough in that currency.

Sit back and enjoy the savings!

One caveat to note regarding PayPal and your Wise card. PayPal does not let you select the currency for billing agreements. Instead, PayPal kindly does the conversion to your base currency for you. You don’t get a choice so be careful with this.

I would recommend using your Wise debit card directly with merchants whom you have ongoing payments arrangements with to ensure you are getting the savings and not potentially doubling up on your exchange fees.

It’s so frustrating to have a USD balance, expect a payment to come out in USD, but instead, PayPal converts it to AUD for you, which means you are billed in AUD and thus Wise has to convert your USD to AUD. Subsequently, you are paying double exchange fees and it costs you way too much.

On a side note, it is possible to add your Wise USD account to your PayPal account to withdraw USD funds from PayPal, however, as of November 2020, PayPal charges a 3% fee to withdraw USD from Australian PayPal accounts to USD bank accounts. Ouch. The current list of PayPal fees for Australian accounts is 这里.

而已!

That’s all there is! That’s how you can save money using foreign currency accounts in Wise (formerly TransferWise) and paying using your Wise debit card.

If you want better value currency exchange for business use, as I do, Wise also has a brilliant business account, TransferWise for Business.

Got more tips on saving money with Wise? Let me know in the comments below!

Was this helpful? Pin it and help someone else out!

《How to use Wise (formerly TransferWise) Borderless foreign currency accounts to save money》有4条留言

I’ve never used TransferWise, but it seems like a modern, convenient, and cost-saving way to do it.

Thanks Kev, it definitely is. I use it all the time for overseas purchases and travel. It works really well and is much cheaper than the rates my bank charges.

This was interesting. Thank you for sharing.

Thanks and no problem at all. I hope it was helpful for you when it comes to the TransferWise Borderless card. It’s a great tool!