ING 澳大利亚 has recently informed customers of a new savings service called Everyday Round Up, which is nearly identical to the Acorns investment model. It’s a great offering that I think will help customers get saving. Is it worthwhile though?

Before I get into this, I have to note that I’m not a financial planner or adviser and this information is meant to be exactly that, information. It’s written with the goal of helping you understand what this service is and whether it is right for you, but at the end of the day, I don’t know your financial position and only you can make that decision. So this is general in nature and I am in no way responsible for any decisions you make or any losses that it may result in. If you make money though, I’m more than happy to take credit and you are welcome to send me your thanks 🙂

What is it?

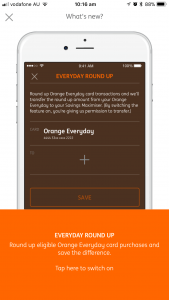

Everyday Round Up is an optional service for customers that hold both an Orange Everyday bank account and a Savings Maximiser bank account.

The goal is to save the change by rounding up your Orange Everyday purchases to the nearest dollar and transferring the change into your Savings Maximiser account.

它是如何工作的?

Switching it on is as simple as the press of a few buttons in the ING mobile app, and once it’s running your saving begins.

Once you select the account you want to use to round up from and to, you can choose whether to round up to the nearest dollar or the nearest five dollars.

Every time you make a purchase, the difference to the next dollar or five dollars is put into your savings account. Once it’s there, it begins counting towards your balance for interest calculations immediately.

Interest is calculated daily and paid monthly on the balance of your Savings Maximiser account based on the current interest rate as indicated on the [eafl id=”4400″ name=”ING Bank Savings Maximiser Account” text=”ING website”]. So every cent you add will help you reach your savings goal quicker. This is especially true if you also have more than $1000 deposited into your Orange Everyday account each month so you get the bonus interest on your Savings Maximiser account.

Is it worthwhile?

If you aren’t regularly saving or investing money then this is a great tool to help you towards your savings goals.

It’s important to remember though that at the end of the day, no matter how much you spend, it’s only going to be a matter of cents that are saved on each purchase if you round up to the nearest dollar, so it will not be a significant amount you save. For comparison, I’ve been using Acorns, which functions on round ups as well, since it’s launch in February 2016 and so far, in 20 months with it rounding up based on every account my wife and I have, including my business account, it’s only invested $3,188. So even putting every purchase you make on your Orange Everyday card, it is still not going to be heaps that you save. The five dollar round up option though is a slightly different story. By using that option you could potentially be saving up to four dollars more for each card transaction, and that can add up quite a bit faster.

As the saying goes though, “from little things, big things grow.” It is important to start somewhere, and if you don’t have a regular savings plan, then this is absolutely a great way to start saving.

Yes, it is worthwhile if you are not already saving regularly.

优点

- Easy to use.

- No actions required after you turn it on.

- One of the highest bank interest rates around at the moment (if you are earning the bonus interest as well).

- No new accounts required if you already have an ING Orange Everyday and Savings Maximiser.

- Can automatically open a Savings Maximiser account from the ING app if you only have an Orange Everyday account.

- Can round up to the nearest dollar or nearest five dollars giving you an option to save faster if you can afford it.

- Money saving that you don’t have to think about or plan.

- Great for those that struggle to put money aside.

- Small amounts are saved at a time making it less of an impact on your weekly budget than a large sum.

- No account fees.

- Easy to get the money out if you need it – just transfer it back to your Orange Everyday account.

缺点

- Low ROI compared to other investments.

- Must deposit $1000 per month into your Orange Everyday account to receive bonus interest.

- Only rounds up from your Orange Everyday account card transactions, not from bank transfer/Bpay transactions or other accounts.

- Easy to get the money out (a con if you have trouble saving because it is too easy to spend the money before reaching your goal).

- The missing dash in the name will annoy you everytime you see it (or at least it annoys me anyway).

Are there better round up services?

Yes.

At the end of the day, your highest possible return from the ING Savings Maximiser will always be the current interest rate plus bonus interest rate. At present, this is extremely low. At the time of rating, the current interest rate is 1.35% and the bonus interest rate is 1.45% so the total possible interest you can receive is 2.80%.

的 雷兹 app uses account roundups in the same way and began offering an Australian roundup based, managed investment portfolio in February 2016 as Acorns 澳大利亚 before later rebranding to 雷兹. This service leverages managed funds across a variety of markets including the Australian and international share markets, government bonds, the money market and more. As such, these portfolios have the potential to earn much higher returns. Of course, this type of investment is also subject to market volatility meaning you may not see a return every month. However, in the 20 months since I began utilizing 雷兹, my average ROI has been above 8% pa, often sitting between 10% and 12%, much higher even at the lowest end than the current bank interest rates.

You can find out more about how 雷兹 works in my blog post 这里, but there are different portfolios depending on your risks aversion. Some offer much greater security with decreased risk of loss, but lower returns, while others offer greater returns with a higher risk of loss.

In my opinion, this is a much better service because it allows you to easily and cheaply invest in higher return markets, helping you to reach your savings goal faster. That said, it is important to note that these markets are long-term investments, not short term. Long-term is necessary as it will enable your investment to ride out the occasional losses and increase overall.