What is Raiz? With bank interest rates so low, is there another option that can make your money work harder for you? What is micro-investing? Is it worth doing? Is Raiz good? I’ve talked briefly about Raiz a number of times in the past, but I have never done a proper Raiz review and really gone into why I started using Raiz, why I continue using Raiz, and why I think every Australian should use Raiz to help grow their wealth. Raiz is easy to set and forget at a level that is manageable for you with a diverse range of investment options providing different levels of risk to suit your life stage and risk preferences. So, without further ado, here’s my review of Raiz, the micro-investing app.

Renuncia: I’m not a financial expert or professional and this is not financial advice. This article is based on my own experience of a product that I’ve chosen to use. You should do your own research and speak to a financial professional to decide if investing in stocks and bonds through Raiz is right for you. This article is not sponsored or funded by Raiz, but if you use my invite code, MPPXWB, you can get $5 when you sign up and I get $5 in return for inviting you.

So, what is Raiz?

Raiz is a micro-investing app that allows you to invest in both domestic and international stock markets, corporate bonds, government bonds and as of 2020, one investment option includes Bitcoin as well.

Raiz aims to make investing simple and accessible to everybody by facilitating micro-investments in a thing known as an “Exchange Traded Fund”, typically referred to as an ETF.

What is an ETF?

What’s an ETF you might ask? I wondered that as well, so I researched it and wrote an article explaining what an ETF is over here.

In short though, an ETF is an investment fund that is traded on the stock exchange similar to how a company is traded. That fund manages investments in certain stocks or commodities. The S&P 500 is a well known ETF that holds a variety of stocks in their investment fund. When you invest through an ETF you are buying shares in the investment fund rather than directly in the company. As a result, your money is exposed to far more companies than it could have been had you invested directly.

What do ETF’s have to do with Raiz?

Raiz takes the ETF approach to investing and builds on it further by offering a number of portfolios designed to suit different risk levels. These portfolios are made up of multiple ETF’s. For example, the “Aggressive” portfolio is currently made up of:

- 54% SPDR S&P 200 ETF – Large Australian company stocks

- 23.5% iShares Asia 50 ETF – Large Asian company stocks

- 7.1% iShares S+P Europe 350 ETF – Large European company stocks

- 5.4% iShares Core S&P 500 ETF – Large USA company stocks

- 4% Russell Aust Select Corp Bond ETF – Australian corporate bonds

- 3% iShares Composite Bond ETF – Short term Australian bonds including Government bonds

- 3% Betashares Australian High Interest Cash ETF

In other words, for every dollar you invest, it gets split up between those ETF’s in those percentage rates. Those ETF’s are in turn split up into their respective investments. What this means for you is that regardless of which portfolio you choose, every dollar you put in is invested across a highly diverse range of investments, far more than the everyday person can afford to invest in.

By diversifying your portfolio, you are significantly reducing your exposure to market fluctuations. When stocks in Company A go down, Company B might go up. If the stock market takes a global dip, having a percentage of funds in bonds and money markets can help to reduce the impact of the decline.

For example, I personally use the Aggressive portfolio and when Coronavirus wiped billions off the value of shares worldwide in March 2020, the total value of my investment actually stayed above my capital input. Even if I sold my entire investment then, I would have still made money. Yes, I definitely lost a chunk of my profit. With 90% of the Aggressive portfolio sitting in stock markets around the world, there had to be a decline in value, but the cash and bond components helped to keep the total returns up above my total dollars invested.

The year of 2020 has been a hard one on my Raiz account, but my total return for the year is still 1.55%, which, while low, is higher than bank interest, and the market is picking up with a return of 10% over the last six months.

That’s the power of ETF’s incorporated into Raiz portfolio approach to investment.

Why invest with Raiz

Raiz has no account minimums, low fees and facilitates investing any amount of money at a time with fractional investing. The Raiz ETF-based portfolio’s allow flexibility to choose your risk vs return preference while not requiring you to actually get into the nitty-gritty of stock trading. Here’s a break-down of the reasons why I invest with Raiz.

Investment options to suit different investment preferences

Raiz has 7 different investment portfolios available at the moment to suit different investment preferences based on risk aversion and investment priorities.

Plus, in January 2021, Raiz added the ability to create your own custom portfolio using the ETF-based asset mixes available from all other portfolios (plus a couple of new ETF options as well).

Rais Investment Portfolios

- Conservative

- High weighting towards fixed income bonds and cash investments.

- Minimum suggested investment period: 3 months

- Risk rating: Low

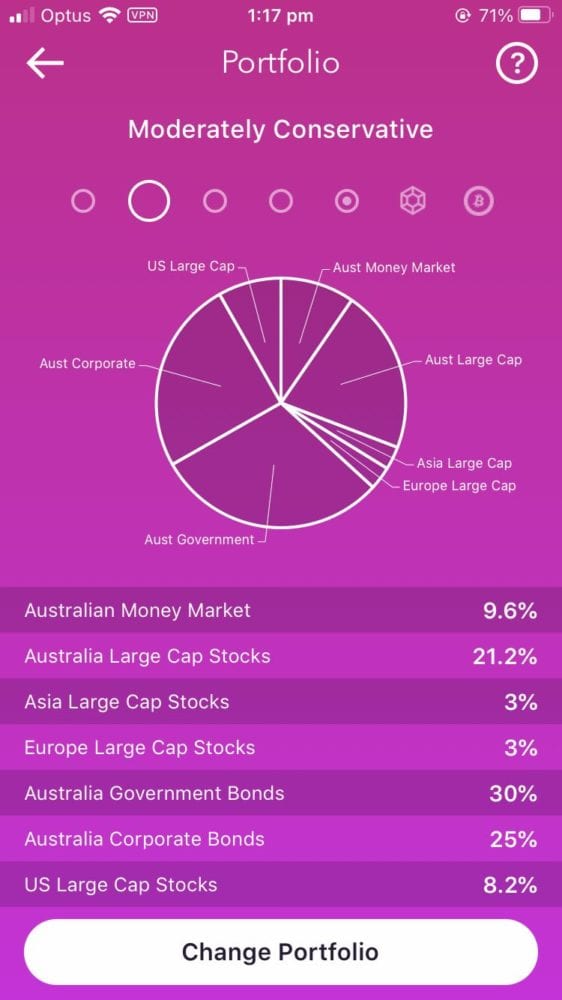

- Moderately Conservative

- Moderately high weighting towards fixed income bonds and cash investments

- Minimum suggested investment period: 1 year

- Risk rating: Low to moderate

- Moderate

- Balanced weighting between fixed income bonds and stocks.

- Minimum suggested investment period: 2 years

- Risk rating: Moderate

- Moderately Aggressive

- Moderately high weighting towards Australian and International stocks

- Minimum suggested investment period: 3-5 years

- Risk rating: Moderately high

- Aggressive

- High weighting towards Australian and international stocks

- Minimum suggested investment period: 5-7 years

- Risk rating: High

- Emerald

- Moderately high weighting towards socially responsible Australian and international stocks

- Minimum suggested investment period: 3-5 years

- Risk rating: Moderate to high

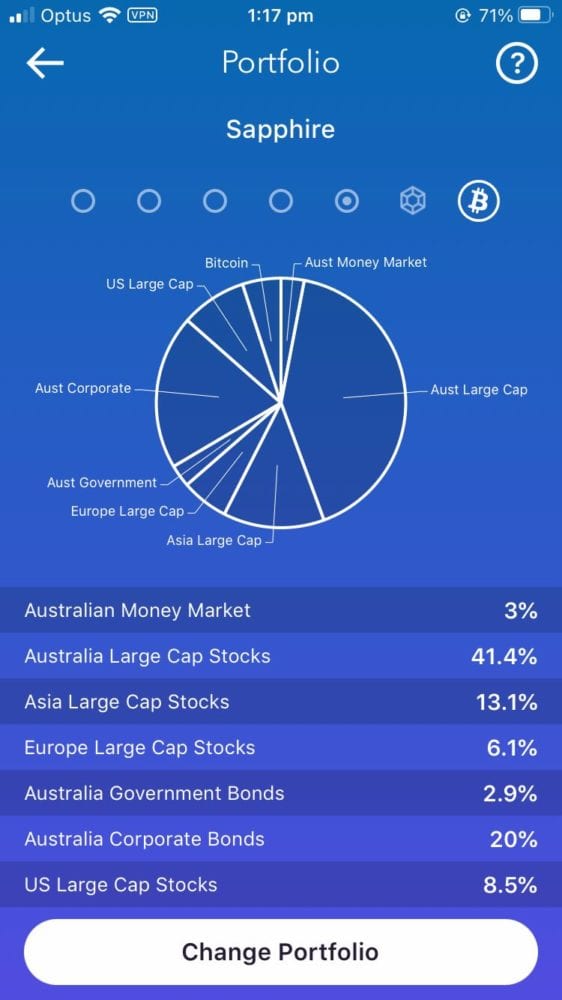

- Sapphire

- High weighting towards Australian and international stocks with a 5% Bitcoin allocation

- Minimum suggested investment period: More than 5 years

- Risk rating: Very high

For more information on the Raiz Investment Portfolios, see the Raiz PDS.

This variety of portfolios works really well. My wife and I have two Raiz accounts, our long-term investment account, and our short-term investment account. Long-term is an investment we add to regularly but have no intention of drawing on anytime soon. It’s invested in the Aggressive portfolio and is intended for future growth towards unknown future major expenses or investments. Our short-term investment account is in the Moderately Conservative portfolio and is intended for planned expenses within the next 12-18 months, like major holidays.

We decided to go with Moderately Conservative for our short-term investments as this fund has historically shown a higher return than the Conservative fund while retaining a reasonably low risk of capital loss. We’ve seen a 1.92% return throughout 2020 (yes, higher than the overall return on the Aggressive fund for 2020), down from previous years, but higher than if the funds were in a bank savings account.

My only complaint about these portfolios is that it is not possible to invest in more than one portfolio at a time with a single account. I would really like to put a percentage of our long-term investments in the Emerald and Sapphire portfolios but I cannot have funds in multiple portfolios at a time. If I want to invest in another portfolio I have to sell the entire Aggressive portfolio and convert it to the new one.

The only way to have funds in more than one portfolio is by having multiple accounts, and each individual can only have one account. It works ok for us since my wife and I have one account each, allowing us to invest in two portfolios, but I’d still like to be able to split our long term investment fund across Aggressive, Emerald and Sapphire.

The new custom portfolio option does go some way to helping since you can customise your asset mix.

Ease of investing and withdrawing

One of the reasons I suggest Raiz for investing, especially for people new to investing is that it is extremely easy to get started.

- Sign up for an account. If you use this link and my invite code, MPPXWB, you’ll get a $5 bonus to get you started.

- Choose your portfolio, verify your details and configure a funding account.

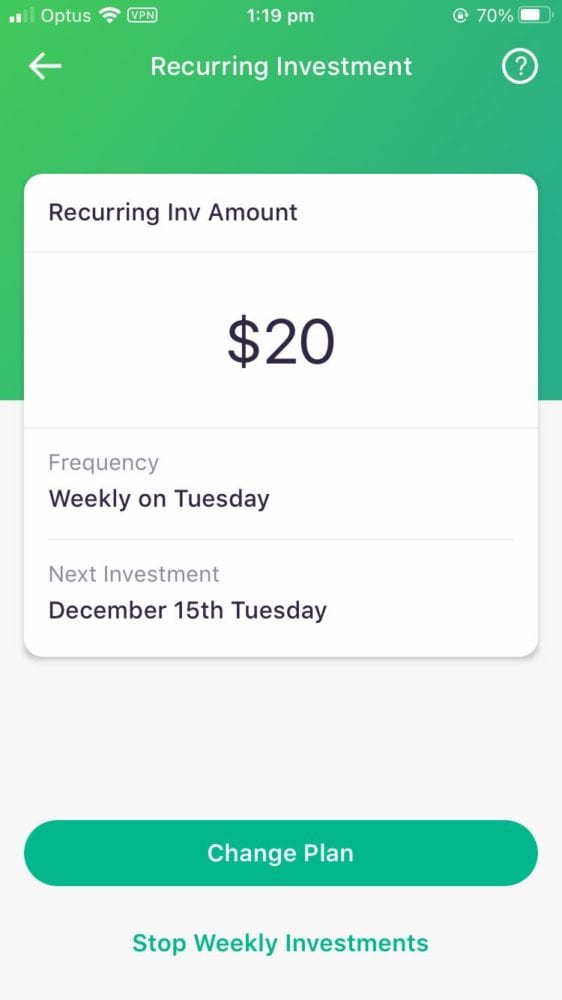

- Set up a recurring deposit (can be daily, weekly, fortnightly or monthly).

- Watch your investment grow.

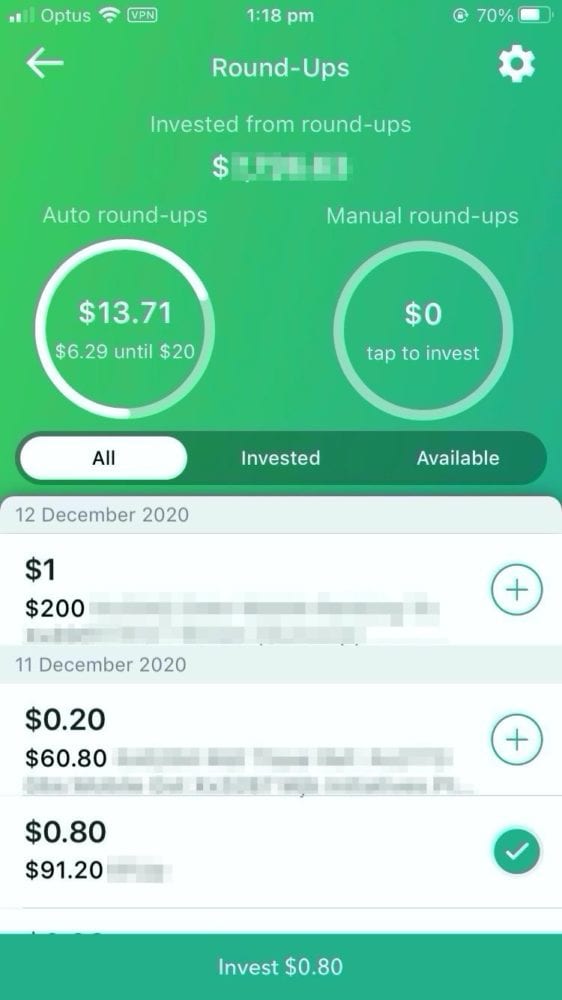

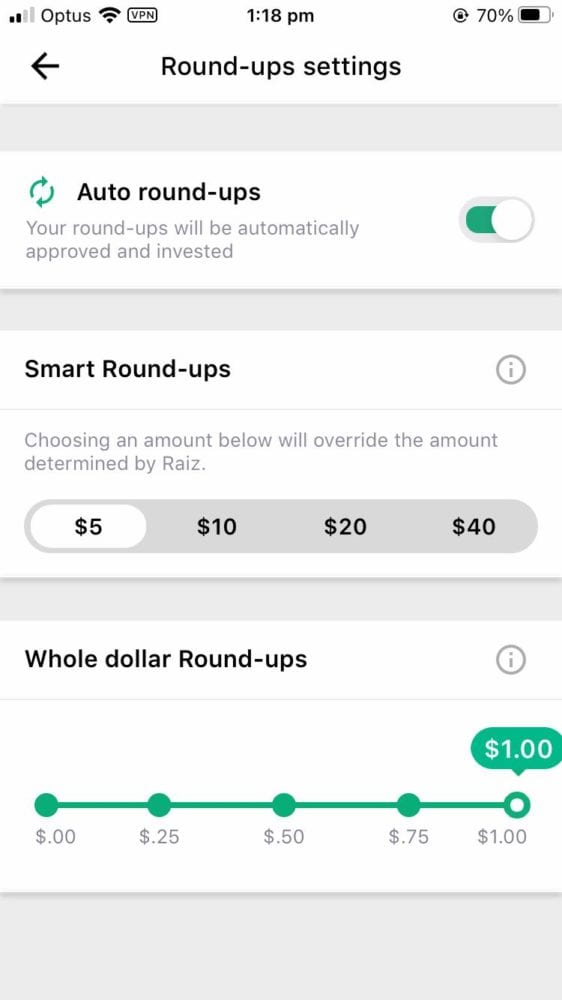

You can also setup Raiz to make automatic round-up investments. These are micro-investments that happen automatically each time you spend money on your designated spending accounts. When you link a bank account to Raiz as a spending account, Raiz will look for transactions where money is being debited from your spending account. Raiz will then round up the difference to the nearest dollar and invest it for you.

For example, if you buy something for $3.60, Raiz will invest $0.40 (the round-up amount) into your portfolio for you.

Round-ups are a brilliant way to help boost your investment in a way that is almost unnoticeable. Something as simple as a $5 weekly investment combined with round-ups can grow your total investment very quickly without having to think about it.

If you can’t do recurring weekly transactions, or round-ups, or if you just want to manually add funds to your investment, you can invest any amount manually at any time. It usually takes around three days for investments to be completely processed. This is made up of a combination of bank transfer time and purchase time.

Similarly, if you need to get money out of Raiz, you can withdraw any amount to your funding account at any time. I find it usually takes around five days for funds to be received back into my funding account. According to Raiz, this is a combination of ASX settlement time and bank transfer time.

I wish transfers for both deposits and withdrawals happened a little quicker, but it’s only a minor complaint.

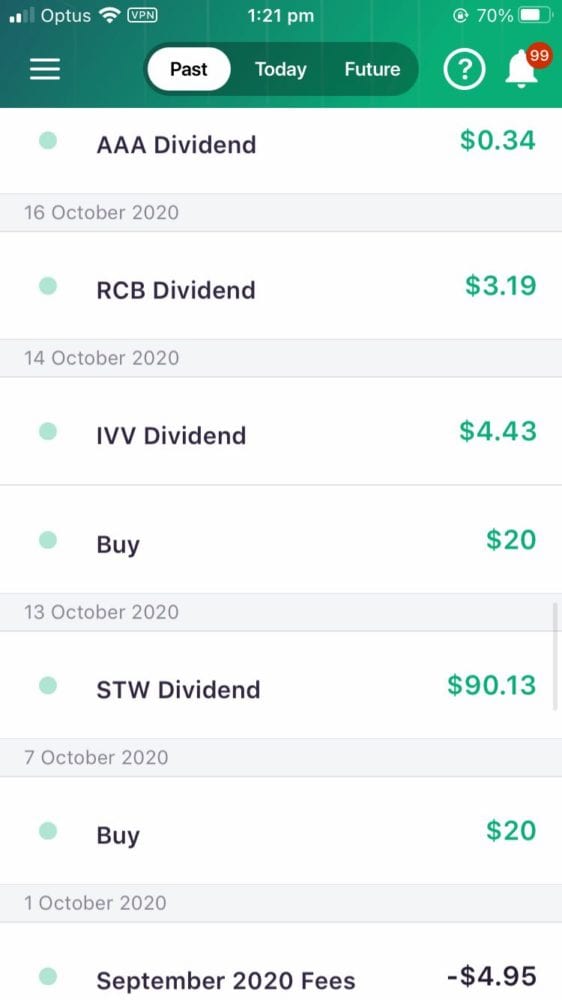

You still earn dividends and distributions

One of my concerns about investing through a portfolio-ETF system like Raiz was whether or not I would receive dividends and distributions from my investment, and how that would work. Back in the day when I had shares in Aurizon directly, I used to love the quarterly dividends that appeared in my account that presented a much higher return than bank interest, even without taking into account any change in share value.

Well, with Raiz, you do receive all dividends and distributions that come through each ETF in the portfolio. These funds are automatically reinvested into your portfolio for you, helping contribute to your overall investment growth. You can choose to withdraw these dividends if you wish by going through the normal withdrawal process.

What about fees?

Raiz has a relatively simple fee schedule. Fees are charged monthly based on your account balance and portfolio type. There are no fees for deposits or withdrawals, which is pretty awesome considering traditional investment methods incur fees on every buy and sell order.

See the Raiz PDS for full fee details.

I’ve broken Raiz fees into the visible fees you pay and the invisible ones that you don’t see but reduce the value of your investment.

Visible fees

If your investment is under $10,000 in total value, then you simply pay a $3.50/month maintenance fee.

If your investment is over $10,000 in total value then you pay a 0.275%/month account fee.

If you invest in the Sapphire portfolio, you pay both the $3.50/month maintenance fee and the 0.275%/month account fee regardless of total value of your investment.

Custom portfolios pay a $4.50/month maintenance fee for balances under $20,000 and an 0.275%/month account fee for balances over $20,000.

You may also be charged a dishonour fee of up to $5 in the event that your bank rejects a debit payment. This isn’t always charged and Raiz only indicates that it will be charged in some circumstances.

If you specially request documents outside of the ones provided regularly there is a $25 document request fee.

Invisible fees

The invisible fees are also the only fees that are a little confusing. They are the underlying issuer fees and the netting spread.

All accounts incur underlying issuer fees that are charged by the underlying funds. The fees vary but at the time of writing are all under 0.5%. You don’t see these fees as they are charged by the underlying ETF. They simply reduce the value of your overall investment.

The netting spread is derived from the stock market spread concept that is the difference between the lowest asking price and highest offered price. See this article on Investopedia for more information on a spread. The netting spread fee charged by Raiz is based on not needing to go to the market to buy your investment or part of your investment.

In other words, since Raiz allows you to buy fractional shares (or part of a share), there are going to be fractions or percentages left over. Raiz has to buy the remaining fraction of the share, and so they hold that part. For example, let’s say your deposit resulted in buying 60% of a share in one of the underlying ETF’s, that means Raiz has bought the other 40% and is holding it. When another investment is made that can take ownership of that remaining 40%, Raiz doesn’t have to go to the stock market to buy that 40% and can sell it directly to the investor.

Without going to market, Raiz doesn’t have to pay fees, but by charging a netting spread, it helps to cover costs without the need for Raiz to charge their own brokerage fee. So what actually is the netting spread? It’s half of the difference between the current lowest asking price and highest offered price. This fee isn’t shown directly in your fees but instead just reduces the total amount of your investment.

Fee Summary

The only fees you really need to be aware of are the maintenance fee and account fee. While the other fees do impact your overall investment value, these ones are the ones that you need to expect to be charged. These fees are debited from your investment funds so you don’t see any extra charges to your funding account and the balance of your investment takes into account the fees you have paid.

See the Raiz Fees page for the latest fee information.

See the Raiz PDS for full fee details.

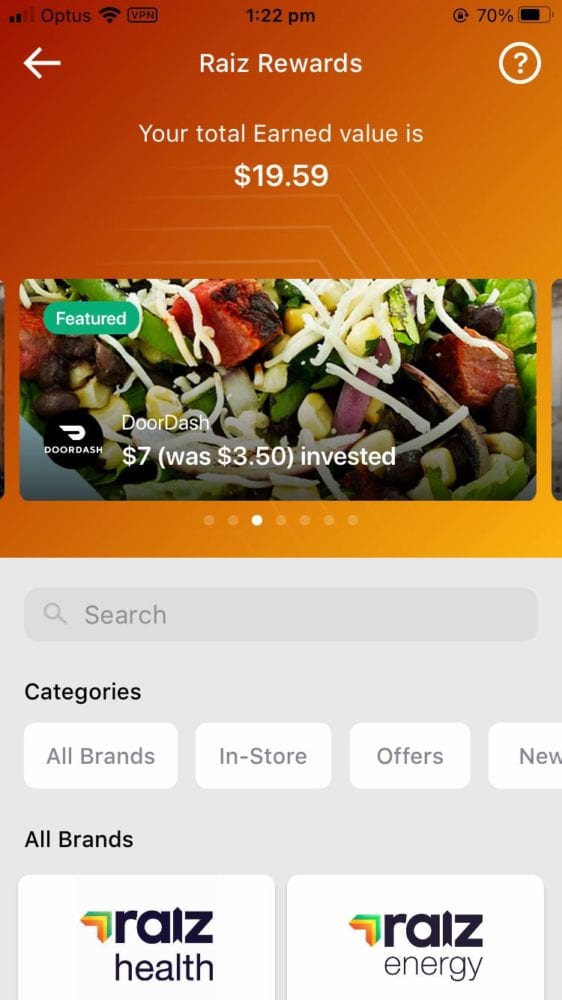

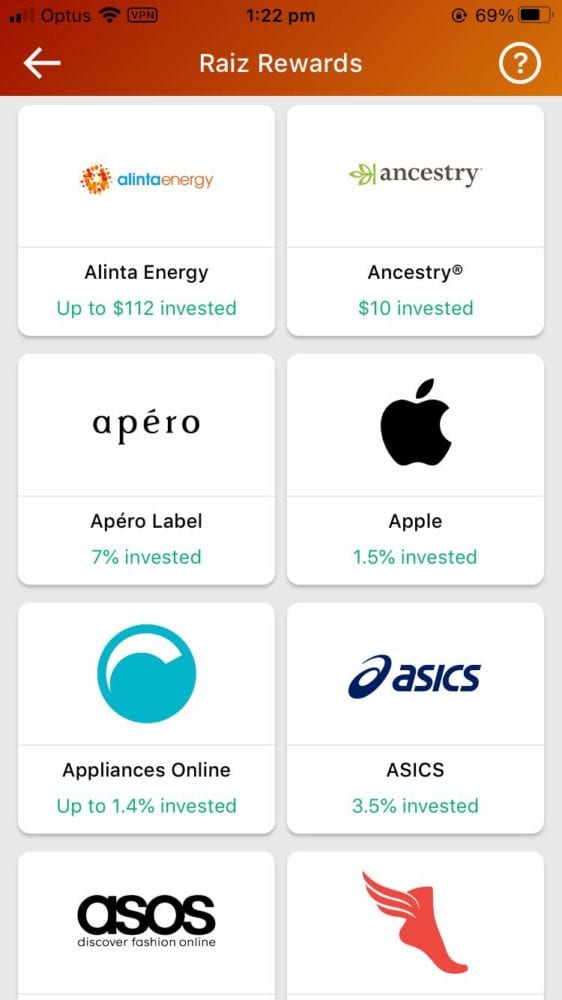

Raiz Rewards

Raiz Rewards used to be called “Found Money” and is a cashback shopping scheme where merchants will reward you with cash directly into your Raiz investment account in return for shopping with them. Some rewards are dollar amounts and others are percentages. Most sit around the 1-5% mark. So if you spend $100 with one of the participating merchants, you will receive a few dollars invested back into your Raiz account at no cost to yourself.

Raiz Rewards works by visiting the rewards section of the Raiz app or website and following the link to your desired merchant. Make sure you follow the link to ensure that your purchase is tracked correctly. Once you complete your purchase, your cashback reward will typically be deposited into your account within 30-120 days as long as you have met the reward requirements and haven’t returned your order.

Raiz Rewards has also started to recently add in-store reward options. These are purchases that are tracked based on your spending account. So when Raiz detects a purchase on one of your linked credit or debit cards that matches the merchant details of an in-store rewards merchant that you have activated, you will receive the cashback reward.

I think that Raiz Rewards is a great way to help boost your investment in a way that doesn’t cost you any extra and rewards you for purchases you were going to make anyway. I especially like the newer in-store rewards merchants as that is even easier. It is a bit of a pain that you do have to go into the app or website and click the link to make sure that each purchase is tracked, but free money is free money right?

Just make sure you don’t find yourself spending more to shop with a Raiz Rewards participating merchant. For example, If something costs $15 from a Raiz Rewards merchant with a 5% reward, that is still costing you more than if you bought it from a non-participating merchant for $10.

I’ve previously blogged about how Raiz Rewards works here. Have a look for more information on how the system rewards you for your purchases.

Raiz Kids – child accounts

Raiz Kids child accounts are a way of investing money for your children that can be divested to them once they are over 18. I’m personally not a fan of how the system works, but I do think it is a great way of saving money for your kids future.

Raiz Kids child accounts allow you to create children within your Raiz account. These children are then allocated a percentage of your total Raiz investment. As your investment grows, so does theirs. While your children are minors they don’t have any access to this and it is all managed through your Raiz account. Once they are old enough though, their account can be split off into a new account in their name.

The main reason I’m not a fan of this is because you can’t specifically invest into the child accounts, they just grow as yours grows.

Transparency and historic performance

Raiz has been around since 2016 and listed on the Australian Stock Exchange in July 2018. Raiz publishes regular updates to the ASX and on their own blog which provide some great insight into how each fund performs.

Being an ASX listed company, Raiz has obligations to disclose performance data which gives customers like us the ability to see how the company is performing and make an informed decision about whether or not to trust them with our funds.

You can find Raiz on the ASX aquí.

Doing a quick Google search for “Raiz performance <YEAR>” (where <YEAR> is the year you want to see) will find their blog posts showing past performance of each portfolio for the desired years.

For example, here is the financial year 2018-2019 and here is the financial year 2019-2020.

Remember, past performance doesn’t necessarily mean future performance will be the same. However, I do find it valuable to see how different portfolios have performed historically compared to each other.

How to invest with Raiz

This is how I invest using Raiz. I’ve made use of all of the investment options and they are all simple to get up and running so you can start growing your wealth. So in this section, I’ll show you how to get your Raiz account set up and connected so you can start investing.

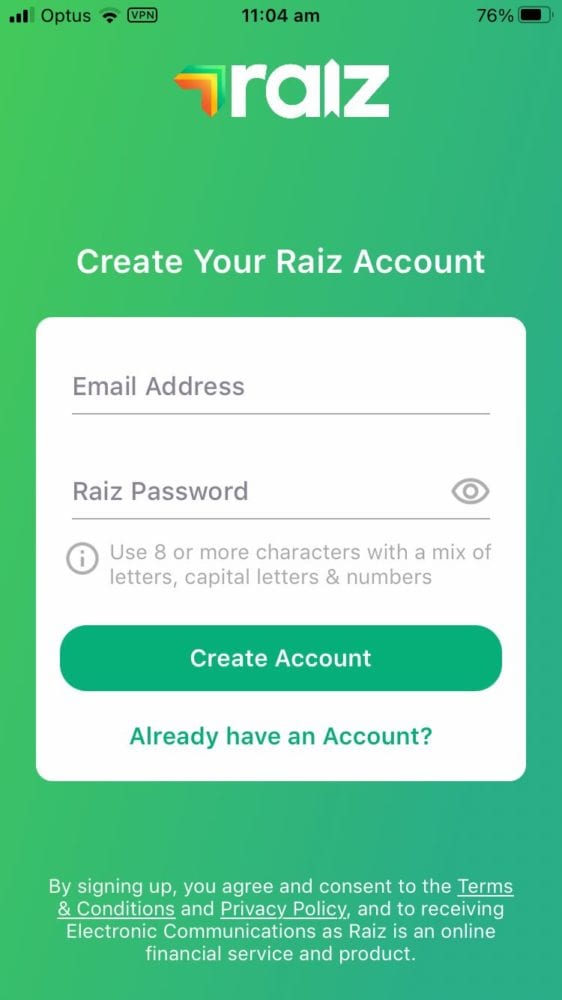

Sign up for an account.

First up, head over to Raiz or download the app via the Apple App Store or Google Play Store and sign up for an account.

If you use this link along with my invite code, MPPXWB, you’ll get a $5 bonus to get you started. Full disclosure, I’ll also get a $5 reward for referring you. I’m hoping though that this article has been helpful enough that you might think it is worth the $5 reward we both get.

Make sure that when you are prompted to enter an invite code, you enter the code. MPPXWB, to ensure that you get your $5 referral bonus.

The signup process is intuitive and will guide you through the process of choosing your portfolio, verifying your details and configuring a funding account.

You can choose to set a savings goal as well so you can track your progress against your goal.

Tax implications of investing with Raiz

From a tax perspective, in Australia, Raiz is considered a managed fund. Each financial year, Raiz provides a statement for you that indicates what items need to be entered in your Australian tax return. The process is reasonably straight forward.

If you don’t withdraw (sell) any of your investments in a financial year, the key things to be aware of are:

- You will have dividends and distributions from a managed fund.

- Some of these distributions will be franked (already taxed so you get a tax credit) and some won’t be (so you will have to pay tax on those ones).

- You can claim your Raiz fees as a tax deduction.

If you do withdraw (sell) any investments then you may have capital gains or capital losses that you will need to report in your tax return.

If you aren’t sure how to complete your tax return, make sure you speak to an accountant to get assistance. I can’t provide advice on how to accurately completely your tax return.

Raiz Review Final Thoughts

Pros

- Easy to invest.

- Facilitates fractional investing.

- Simple fee structure.

- Low fees.

- Can invest any amount.

- No brokerage fees.

- A variety of portfolios to choose from that suit different life stages and risk preferences.

- Raiz Rewards are a great way to boost your investment.

- The built-in financial analysis section of the app can be helpful for seeing where you are spending money and helping you to find areas where you could be saving more.

- Child accounts are a great way to invest money for your children’s future

- Raiz is an ASX listed company providing a level of transparency.

- Past performance for each portfolio is shared in the Raiz blog.

- Savings goals can help with motivation for reaching your goal.

- Custom portfolios are a great way to take a bit more control over your investment without the complexity of direct investing.

Contras

- Can only invest in one portfolio at a time.

- Child accounts are not very flexible.

- Investment and withdrawal transfers could be faster.

- No fee-free investment tier for those just starting out who only have small balances.

Other thoughts about Raiz

I’ve been using Raiz since it was first launched in Australia as “Acorns” in February 2016. So I’m coming up to my fifth year using Raiz. In that time, I’ve seen an overall return of 32.27%, even after the Coronavirus induced market crash of 2020.

Over that time, I’ve seen typical annual returns between 10% and 28% with dividends along returning more than bank interest would have.

If you want to invest small amounts of money and help yourself save money at the same time, Raiz is an excellent way to do it. I can’t recommend it enough.

You can just let Raiz run in the background investing your round-ups for you which is not really noticeable on your bank balance at all. And you can set up an automatic investment to transfer money in each week/month. When you have some spare cash, you can also manually invest additional funds if you like. It all contributes to helping grow your investment, but if you don’t think you have spare cash to do anything with, just using the round-ups are an excellent way to start investing in stocks and bonds to increase your wealth!

When it comes to value for money, Rais is one of the best ways to get value out of investments without needing to put aside large sums of money to invest in a single stock.

My wife and I now have many shares in things like the S&P500 that I never thought would be practical for us to invest in. I think my entire extended family have started using it now (including those that already invest directly in stocks) because it makes investing so simple!

Just remember, it’s a long-term investment, not short. Some months the values will go down. This is especially true for the more aggressive portfolios. Over the long term though, the return has been fantastic for us.

Raiz Super

Just as a final tidbit, Raiz offers a superannuation product as well. I’ve never used it, so I can’t provide any real comment on it, but it does function based on the same portfolio system as the core Raiz platform.

Get investing!

If you want to sign up for Raiz y empieza a invertir, asegúrate de usa mi enlace de referencia aquí con mi código de invitación, MPPXWB, para obtener una inversión adicional de $5.00 cuando se registre.

What do you think about Raiz?

Estoy ansioso por escuchar lo que piensas sobre el Raiz plataforma de inversión. ¿Lo has usado? Aún lo usas? ¡Déjame saber lo que piensas en los comentarios a continuación!

References and resources

¿Te resultó útil este artículo ¡Póngalo para que pueda ayudar a otra persona también!